By Patricia Amend, AARP

Published January 19, 2024

The rate of inflation fell in 2023. The Consumer Price Index, the government’s main gauge of inflation, rose 3.4 percent for the 12 months that ended in December, compared with 6.5 percent in December 2022. But that doesn’t mean that the cost of living has gone down; it’s just rising at a slower rate. What to do?

Paying less in taxes is a good start.

Americans are dealing with inflation in many ways. People have created budgets, reduced spending, and started taking part-time side jobs for extra income, according to a study by the financial services company Empower. And that helps: The study indicates that 68% of those surveyed said they’ll be ready for retirement when the time comes.

But don’t forget that big chunk of change you send to Uncle Sam every year. And at age 50, you become eligible for some considerable tax benefits, which can help if you’re behind on your retirement savings goals.

Estimate Your 2023 Taxes

AARP’s tax calculator can help you predict what you’re likely to pay for the 2023 tax year.

Now you can contribute more to your traditional individual retirement account (IRA), Roth IRA or to your employer-sponsored plan or to your health savings account (HSA).

“It is enough to pick up your pace if you’re feeling behind, especially if you’ve got more disposable income and fewer expenses,” says Jacqueline Koski, a certified financial planner (CFP) in Dayton, Ohio, who serves on the board of the Financial Planning Association (FPA).

Here’s how to take advantage of the tax laws to catch up, if needed. If you’re already retired, or close to it, these laws can enable you to reduce your tax bill. That’s too good to pass up.

1. Contribute more to your retirement plan

“The most important ‘kicker’ when one is over 50, is the additional deductible contribution to a 401k or IRA,” says John Power, a CFP at Power Plans in Walpole, Massachusetts. “These are often the highest earning years, and they often synchronize with children becoming independent.” If this is your case, and your expenses are lower, then Power encourages maximizing your retirement savings.

For 2024, the contribution limit for employees who participate in 401(k) and 403(b) programs, most 457 retirement saving plans and the federal government’s Thrift Savings Plan has been increased to $23,000, up from $22,500 in 2023. Employees 50 and older can contribute an additional $7,500, the same as for 2023, for a total of $30,500.

The contribution limit for a traditional or Roth IRA is $7,000, up from $6,500 for tax year 2023. The catch-up amount is $1,000, the same as 2023. The 2024 catch-up contribution limit for a Savings Incentive Match Plan for Employees (SIMPLE) plan is $3,500, unchanged from 2023.

Unfortunately, attractive as these catch-up provisions are for folks 50 and older, a mere 16% of those who are eligible have been making these contributions, according to “How America Saves 2023,” a report by Vanguard.

At the same time, data from the National Retirement Risk Index compiled by the Boston College Center for Retirement Research, indicates that about half of American households are at risk of being unable to maintain their preretirement standard of living in retirement.

In addition to making your retirement more secure, contributing to a tax-deferred retirement plan, such as an IRA or a 401(k), will also reduce your taxable income—which, in turn, reduces the taxes that you’ll be required to pay. Increasing your contribution won’t reduce the amount of your paycheck as you might think, thanks to the reduction in taxes.

Let’s assume your salary is $35,000 and your tax bracket is 25%. Contribute 6%—$2,100—and your taxable income will be reduced to $32,900. The income tax you’ll pay on $32,900 will be $525 less than on $35,000, according to figures from Intuit TurboTax.

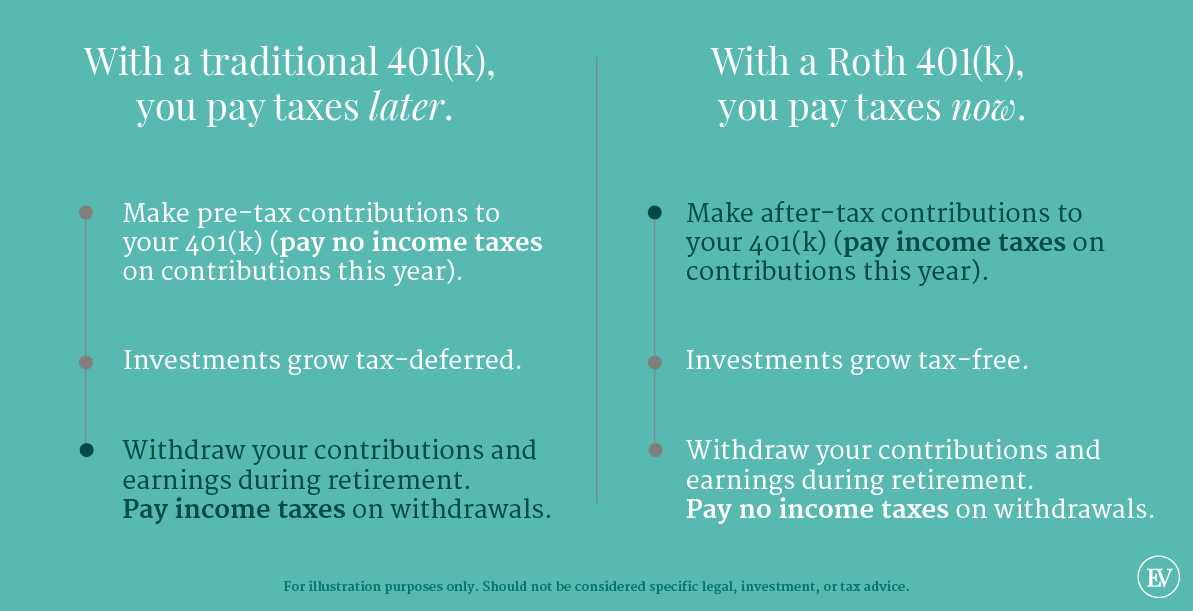

To be clear: Retirement contributions made to a Roth IRA or Roth 401(k) are made on an after-tax basis. That is, you get no up-front tax break for these contributions, but the qualifying withdrawals that you take in retirement will be tax-free. However, when you contribute pretax money to a traditional IRA or a 401(k), it will grow tax-free. But you’ll be liable for taxes once you start making withdrawals in retirement.

Keep in mind that the tax deduction you receive may be limited if you are (or your spouse is) covered by a workplace retirement plan and your income exceeds certain limits. According to the IRS, for 2024, IRA deductions for singles covered by a retirement plan at work aren’t allowed after modified adjusted gross income (MAGI) reaches between $77,000 and $87,000. MAGI is your adjusted gross income, minus certain deductions, such as student loan interest.

For married couples filing jointly, if the spouse making the IRA contribution is covered by a workplace retirement plan, the phase-out range is increased to between $123,000 and $143,000. If an IRA contributor is not covered by a workplace retirement plan, and is married to someone who is covered, the phase-out range is between $230,000 and $240,000.

Roth IRAs also have income limits. For 2024, the income phase-out range for taxpayers making contributions to a Roth IRA is increased to between $146,000 and $161,000 for singles and heads of households. For married couples filing jointly, the income phase-out range is increased to between $230,000 and $240,000.

When it comes to catch-up contributions for a traditional IRA or Roth IRA, you still have time to do so for the 2023 tax year. The deadline is April 15, the filing date for your tax return, unless you file for an extension. However, 401(k)s, 403(b)s, Thrift Savings Plans and most 457 plans go by the calendar year, so you’ll be investing for 2024, and will have until the end of the year to do so.

2. Ease the pain of RMDs

Obviously, the longer you tap your retirement savings, the less you’ll have over your lifetime, and the greater the odds of outliving your money. Nevertheless, you can’t leave it untouched forever. You’ll probably have to face required minimum distributions (RMDs), the minimum amount you must withdraw from a tax-deferred retirement plan, such as a traditional IRA. Roth IRAs don’t require distributions while the owner is alive.

Under rules that kicked in 2023 under the Secure Act 2.0, you can wait until the year in which you reach age 73 before you start taking RMDs. Previously, the age was 72. For your first RMD payment, you can delay it until April 1 of the following year, but you’ll also have to pay another RMD in December of that year.

If you don’t need the RMD, consider donating it to charity. Donate your RMD to a qualified charity directly from your retirement account, up to $100,000, and you won’t owe income tax on the distribution.

3. Max out your HSA

Another often overlooked opportunity lies in Health Savings Accounts (HSAs) that employers offer, says Brenna Baucum, a CFP at Collective Wealth Planning in Salem, Oregon: “For those in their 50s, HSAs offer a unique advantage. By contributing to your HSA, you prepare for future health care expenses and enjoy a triple tax benefit—tax-deductible contributions [from your gross income], tax-free growth, and tax-free withdrawals for qualified medical expenses.”

Also, there’s a small catchup on the health savings account, $1,000, that Sandi Weaver, a CFP at Weaver Financial in Mission, Kansas, reminds her clients to make use of once they reach 55: “We get an immediate tax deduction for that catchup, plus for the basic HSA contribution itself, of course.”

Plus, the account is yours: You can take it with you to a new job and use the funds in retirement.

For 2024, you can contribute up to $4,150 if you have coverage for yourself, or up to $8,300 for family coverage, plus the additional $1,000 catchup if you reach 55 during the year. However, your contribution limit will be reduced by any amount your employer contributed that has been excluded from your income.

4. Enjoy a larger standard deduction at 65

You can look ahead to an additional tax benefit down the road. The standard deduction, which reduces your taxable income and, in turn, lowers your tax bill, will be larger once you reach 65.

In 2024, when you fill out your federal income tax forms for income earned in 2023, if you’re married and filing jointly, you’ll get a standard deduction of $27,700. If you’re a single taxpayer, or a married and filing separately, the standard deduction rises to $13,850.

However, if you are 65 or older and file as a single taxpayer, you get an extra $1,850 deduction for tax year 2023. Married and filing jointly or separately? The extra standard deduction is $1,500 for each person who is qualified. For taxpayers who are both 65-plus and blind, the extra deduction is $3,700. If you are married, filing jointly or separately, it’s $3,000 for each person who qualifies.

There is one drawback for some taxpayers with the higher standard deduction: It sets a high bar for itemizing deductions. Therefore, it doesn’t make sense to go to the trouble of itemizing if your deductions aren’t higher than the standard deduction. Nevertheless, getting a larger standard deduction is a good thing.

Other deductions

What about cash gifts to qualified charities? Back in tax year 2021, single individuals could take a $300 deduction for cash gifts to qualified charities. Married couples could take $600. You could take this deduction if you took the standard deduction and didn’t itemize. But those days are gone. This charitable deduction disappeared in the 2022 tax year.

The high standard deduction means that for most people, it’s not worthwhile to itemize tax returns. But you can deduct some expenses without itemizing, thanks to above-the-line deductions, which are deductible from your gross income before calculating your adjusted gross income (AGI). For example, you can deduct student loan interest that you paid in the 2023 tax year. Other above-the-line deductions:

Teacher expenses. Individuals can deduct up to $300 in unreimbursed teaching expenses, and married couples can deduct $600, assuming both are educators.

Self-employed health insurance. If you’re self-employed, you can deduct the premiums for medical, dental, vision and long-term care insurance.

Alimony paid. The law used to allow those who paid alimony to deduct their payments. No longer. But there’s one loophole: If your divorce or separation agreement was signed before Dec. 31, 2018, you can deduct alimony paid.

Military moving expenses. Active-duty members of the military can deduct their moving expenses when they move because of a permanent change of station.

Patricia Amend has been a lifestyle writer and editor for 30 years. She was a staff writer at Inc. magazine; a reporter at the Fidelity Publishing Group; and a senior editor at Published Image, a financial education company that was acquired by Standard & Poor’s.

Source: https://www.aarp.org/money/taxes/info-2024/tax-breaks-after-50.html