Presented by Ausperity Private Wealth

A backdoor Roth IRA is an informal name for a method used by high-income taxpayers to create a permanently tax-free Roth IRA, even if their incomes exceed the limits that tax law prescribes for regular Roth ownership. This tax avoidance strategy helps you if your income is too high to contribute to a Roth IRA directly, whereby you can still get your money into the account by adding a few steps to the process.

It’s usually worth the extra effort because of the exclusive tax benefits provided by Roth IRAs. Specifically, traditional IRAs and 401(k)s are taxable upon withdrawal (or tax-deferred), while Roth contributions are taxed upfront and then allowed to grow tax-free. Roth IRAs also afford their owners more flexibility when it comes to deploying their retirement cash. Traditional IRAs have what is called required minimum distributions (RMDs), which require their owners to withdraw a certain amount of cash each year once they hit the age of 72.

Similarly, if you can contribute after-tax income to your 401(k), which then may allow afford you the ability to capitalize on a game-changing retirement savings strategy known as the Mega backdoor Roth 401(k)!

How a standard backdoor Roth works:

- Contribute to a traditional IRA account. If you don’t already own a traditional IRA, you’ll need to open one before you can fund it. Ensure that the contributions you make are non-deductible (i.e., post-tax funds) and that you’ve accounted for those contributions in your submission of IRS Form 8606.

- Convert your contributions to a Roth IRA. It’s important that you convert your traditional IRA to a Roth IRA as soon as possible. Failing to do so could allow your non-deductible contributions to accumulate investment gains while within the traditional IRA, which you would be responsible for paying taxes on upon conversion.

- Enjoy the tax protection of a Roth IRA. If you’ve executed it properly, all the taxes you owe will be paid upfront. From here onward, the funds within your Roth will grow tax-free. An added benefit to note is that your beneficiaries will receive tax-free distributions.

Who is the backdoor Roth for?

Backdoor Roth IRA conversions are for investors whose annual earnings are in excess of $144,000 (or $214,000 if you’re filing jointly with a spouse) and are therefore prohibited from making contributions to a Roth IRA. Roth IRAs were originally designed to assist low-to-middle income families in saving for retirement, but the unique tax shelter they provide makes these accounts appealing to retirement-savers of all types. If you’re not able to contribute directly to a Roth IRA because of high income, you can instead make a contribution to a traditional IRA and then convert it into a Roth—effectively bypassing the contribution restrictions.

For 2021 and 2022, the individual contribution limit for traditional IRAs is $6,000. If you’re married and filing jointly with a spouse, the limit is $6,000 per person–or $12,000 in total. Finally, the IRS allows you to contribute an additional $1,000 if you’re over the age of 50–raising the individual contribution limit to $7,000, or $14,000 if filing jointly. Simply stated, you’re able to move $6,000-7,000 per person, per year into a Roth using this legal maneuver. To maximize your retirement savings, it’s recommended that you do this each year for as long as you’re able to.

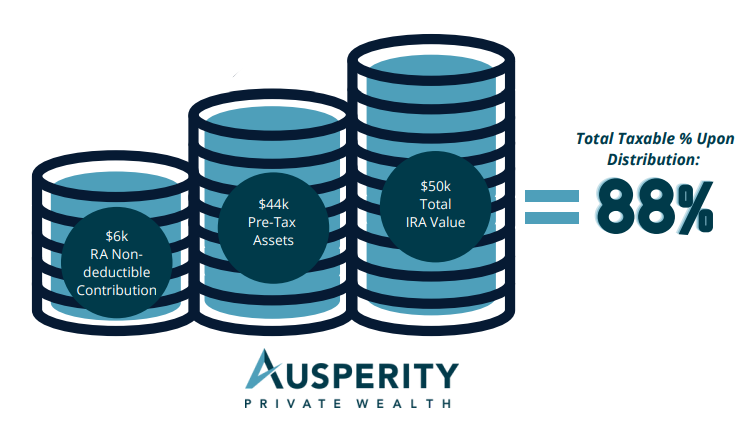

But be careful, if you already have an IRA with pre-tax money in it (from tax-deferred contributions or a rollover from an old 401(k) plan) your conversion and future retirement withdrawals will be partially taxable. This is because the IRS taxes withdrawals containing both pre-tax and after-tax dollars on a pro-rata basis which limits the ability to convert just a new non-deductible IRA contribution. For example, if you have $44,000 in a traditional IRA that has been funded with pre-tax money and then make a $6,000 after-tax contribution your total IRA will be $50,000 and ANY conversion amount or distribution will be 88% taxable!

What is a mega backdoor Roth?

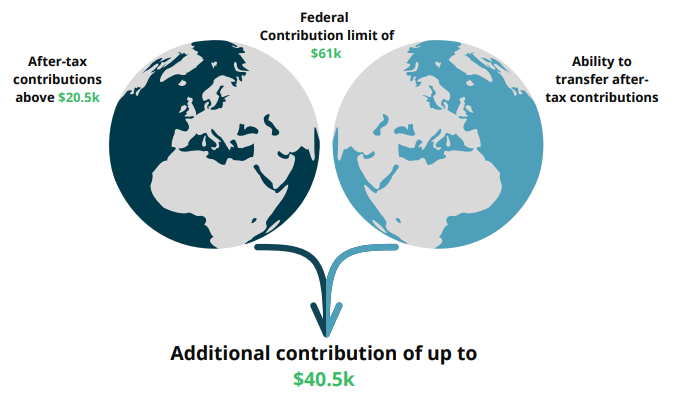

In 2022, if your plan both allows you to make after-tax contributions above the $20,500 limit ($27,000 if you are 50 or older) and to transfer–or convert–those after-tax contributions to a Roth IRA or 401(k), you can get the best of both worlds. You can defer up to $20,500 ($27,000 if you’re 50 or older) by making a pre-tax contribution that also reduces your taxable income and make an additional contribution of up to $40,500 that can be transferred to a Roth IRA.

How a mega backdoor Roth conversion works

If you have maxed out your pre-tax contributions to your 401(k)–the cap is $20,500 ($27,000 if over age 50) for 2022–you may be eligible to contribute additional funds to the account in the form of after-tax dollars. Not every employer-sponsored 401(k) allows you to make after-tax contributions, though, so review the terms of your employment agreement or summary plan description before proceeding. Although you are paying taxes on this cash up-front, you’ll benefit from tax-free growth in Roth if executed properly.

The next step is to make an ‘in-service’ withdrawal or distribution. Most 401(k) plans allow participants to make distributions to a Roth IRA while still employed. It is possible to take this step after you have left your job, but it may entail paying more taxes. Just as with a standard backdoor Roth, timing is essential. After making your post-tax contributions, be sure to make your in-service distribution as quickly as possible to avoid generating any taxable returns. Recently, 401(k) plans have started allowing the Mega Backdoor Roth to occur inside the plan and will assist in moving your after-tax funds to the Roth 401(k) for you. Even better, a few providers allow an automatic conversion feature that converts after-tax assets to Roth the very next business day!

A relevant caveat is that a mega backdoor Roth involves more moving parts than a standard backdoor Roth, so do not try this without consulting a professional first. A financial advisor or tax professional should be able to simplify the process for you and a call to your 401(k) benefit center is recommended.

A Mega Backdoor Roth Example:

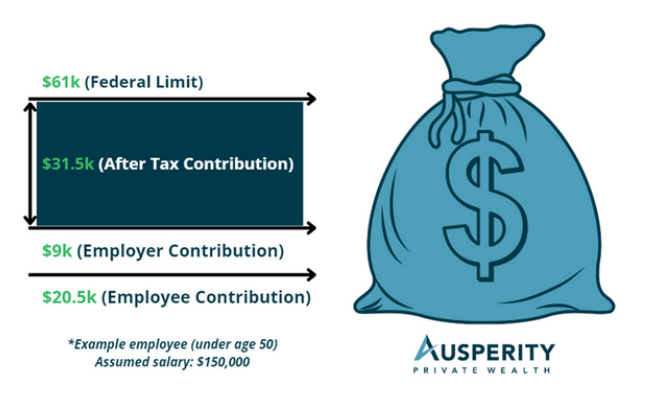

For 2022, the maximum amount that can be contributed is $61,000 inside a 401(k) plan for those under the age of 50. Subtract from this amount the $20,500 in pre-tax contributions plus your employer match (we are assuming a 6% match with a $150,000 salary). Total pre-tax contribution is $29,500. This leaves over $31,500 of after-tax contributions which can be converted to Roth for future tax-free growth!

Need help executing this strategy? Schedule an appointment today!

Sources:

https://www.forbes.com/advisor/retirement/congress-to-end-backdoor-roth-conversions/

https://www.nerdwallet.com/article/investing/mega-backdoor-roths-work#:~:text=The%20mega%20backdoor%20Roth%20allows,2021%2C%20and%20%2440%2C500%20in%202022

https://www.forbes.com/advisor/retirement/mega-backdoor-roth/

https://www.fool.com/investing/2022/01/21/you-can-still-do-a-backdoor-roth-in-2022-but-hurry/

Securities offered through Sanctuary Securities Inc, Member FINRA, SIPC Advisory services offered through Sanctuary Advisors, LLC. A SEC Registered Investment Advisor. Ausperity Private Wealth is a DBA of Sanctuary Securities, Inc. and a DBA of Sanctuary Advisors, LLC. Do not transmit orders regarding your Sanctuary Securities, Inc. account(s) or Sanctuary Advisors, LLC account(s) via e-mail. Sanctuary Securities, Inc., Sanctuary Advisors, LLC, and Ausperity Private Wealth will not be responsible for executing such orders and or instructions. This e-mail message is intended only for the use of the individual or entity to which the transmission is addressed. Any interception may be a violation of law. If you are not the intended recipient, any dissemination, distribution or copying of this e-mail is strictly prohibited. If you are not the intended recipient, please contact the sender by reply email and destroy all copies of the document.