Join us as we discuss planning for the next generation & dive into various tax-advantaged strategies to help set-up our children with their best financial life.

Author: dev

The Backdoor and Mega Backdoor Roth: Does It Make Sense For You?

Presented by Ausperity Private Wealth

A backdoor Roth IRA is an informal name for a method used by high-income taxpayers to create a permanently tax-free Roth IRA, even if their incomes exceed the limits that tax law prescribes for regular Roth ownership. This tax avoidance strategy helps you if your income is too high to contribute to a Roth IRA directly, whereby you can still get your money into the account by adding a few steps to the process.

It’s usually worth the extra effort because of the exclusive tax benefits provided by Roth IRAs. Specifically, traditional IRAs and 401(k)s are taxable upon withdrawal (or tax-deferred), while Roth contributions are taxed upfront and then allowed to grow tax-free. Roth IRAs also afford their owners more flexibility when it comes to deploying their retirement cash. Traditional IRAs have what is called required minimum distributions (RMDs), which require their owners to withdraw a certain amount of cash each year once they hit the age of 72.

Similarly, if you can contribute after-tax income to your 401(k), which then may allow afford you the ability to capitalize on a game-changing retirement savings strategy known as the Mega backdoor Roth 401(k)!

How a standard backdoor Roth works:

- Contribute to a traditional IRA account. If you don’t already own a traditional IRA, you’ll need to open one before you can fund it. Ensure that the contributions you make are non-deductible (i.e., post-tax funds) and that you’ve accounted for those contributions in your submission of IRS Form 8606.

- Convert your contributions to a Roth IRA. It’s important that you convert your traditional IRA to a Roth IRA as soon as possible. Failing to do so could allow your non-deductible contributions to accumulate investment gains while within the traditional IRA, which you would be responsible for paying taxes on upon conversion.

- Enjoy the tax protection of a Roth IRA. If you’ve executed it properly, all the taxes you owe will be paid upfront. From here onward, the funds within your Roth will grow tax-free. An added benefit to note is that your beneficiaries will receive tax-free distributions.

Who is the backdoor Roth for?

Backdoor Roth IRA conversions are for investors whose annual earnings are in excess of $144,000 (or $214,000 if you’re filing jointly with a spouse) and are therefore prohibited from making contributions to a Roth IRA. Roth IRAs were originally designed to assist low-to-middle income families in saving for retirement, but the unique tax shelter they provide makes these accounts appealing to retirement-savers of all types. If you’re not able to contribute directly to a Roth IRA because of high income, you can instead make a contribution to a traditional IRA and then convert it into a Roth—effectively bypassing the contribution restrictions.

For 2021 and 2022, the individual contribution limit for traditional IRAs is $6,000. If you’re married and filing jointly with a spouse, the limit is $6,000 per person–or $12,000 in total. Finally, the IRS allows you to contribute an additional $1,000 if you’re over the age of 50–raising the individual contribution limit to $7,000, or $14,000 if filing jointly. Simply stated, you’re able to move $6,000-7,000 per person, per year into a Roth using this legal maneuver. To maximize your retirement savings, it’s recommended that you do this each year for as long as you’re able to.

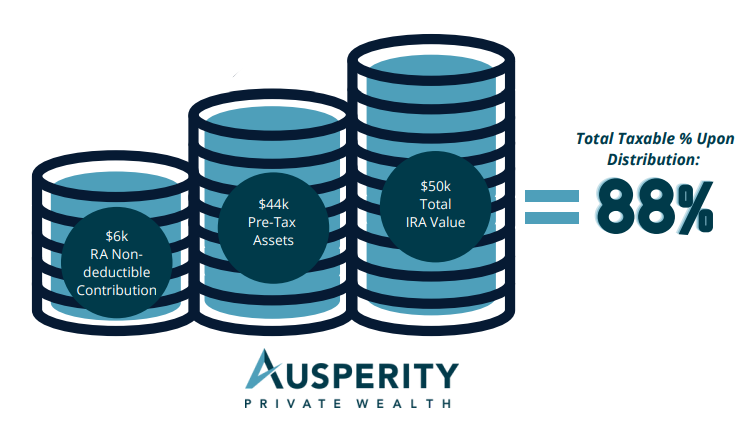

But be careful, if you already have an IRA with pre-tax money in it (from tax-deferred contributions or a rollover from an old 401(k) plan) your conversion and future retirement withdrawals will be partially taxable. This is because the IRS taxes withdrawals containing both pre-tax and after-tax dollars on a pro-rata basis which limits the ability to convert just a new non-deductible IRA contribution. For example, if you have $44,000 in a traditional IRA that has been funded with pre-tax money and then make a $6,000 after-tax contribution your total IRA will be $50,000 and ANY conversion amount or distribution will be 88% taxable!

What is a mega backdoor Roth?

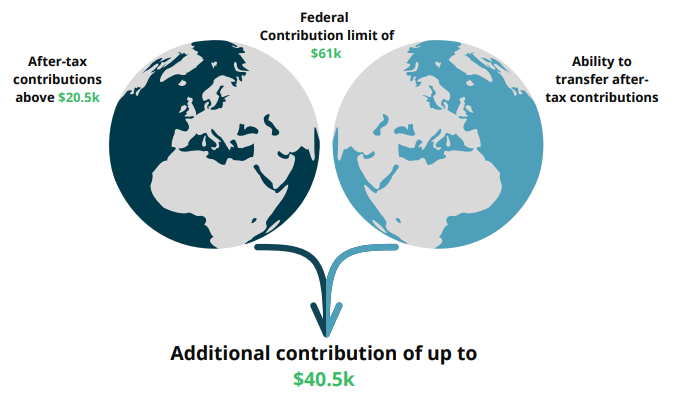

In 2022, if your plan both allows you to make after-tax contributions above the $20,500 limit ($27,000 if you are 50 or older) and to transfer–or convert–those after-tax contributions to a Roth IRA or 401(k), you can get the best of both worlds. You can defer up to $20,500 ($27,000 if you’re 50 or older) by making a pre-tax contribution that also reduces your taxable income and make an additional contribution of up to $40,500 that can be transferred to a Roth IRA.

How a mega backdoor Roth conversion works

If you have maxed out your pre-tax contributions to your 401(k)–the cap is $20,500 ($27,000 if over age 50) for 2022–you may be eligible to contribute additional funds to the account in the form of after-tax dollars. Not every employer-sponsored 401(k) allows you to make after-tax contributions, though, so review the terms of your employment agreement or summary plan description before proceeding. Although you are paying taxes on this cash up-front, you’ll benefit from tax-free growth in Roth if executed properly.

The next step is to make an ‘in-service’ withdrawal or distribution. Most 401(k) plans allow participants to make distributions to a Roth IRA while still employed. It is possible to take this step after you have left your job, but it may entail paying more taxes. Just as with a standard backdoor Roth, timing is essential. After making your post-tax contributions, be sure to make your in-service distribution as quickly as possible to avoid generating any taxable returns. Recently, 401(k) plans have started allowing the Mega Backdoor Roth to occur inside the plan and will assist in moving your after-tax funds to the Roth 401(k) for you. Even better, a few providers allow an automatic conversion feature that converts after-tax assets to Roth the very next business day!

A relevant caveat is that a mega backdoor Roth involves more moving parts than a standard backdoor Roth, so do not try this without consulting a professional first. A financial advisor or tax professional should be able to simplify the process for you and a call to your 401(k) benefit center is recommended.

A Mega Backdoor Roth Example:

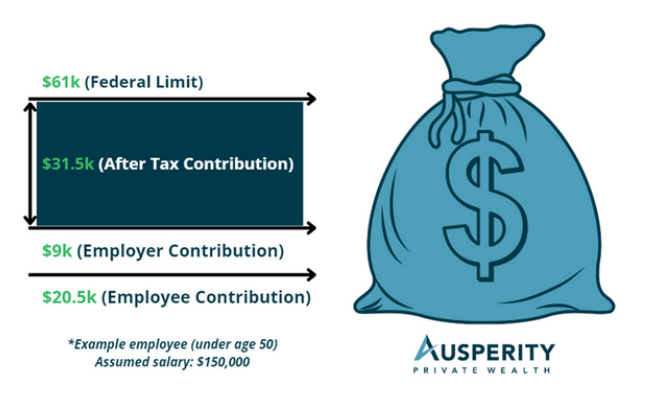

For 2022, the maximum amount that can be contributed is $61,000 inside a 401(k) plan for those under the age of 50. Subtract from this amount the $20,500 in pre-tax contributions plus your employer match (we are assuming a 6% match with a $150,000 salary). Total pre-tax contribution is $29,500. This leaves over $31,500 of after-tax contributions which can be converted to Roth for future tax-free growth!

Need help executing this strategy? Schedule an appointment today!

Sources:

https://www.forbes.com/advisor/retirement/congress-to-end-backdoor-roth-conversions/

https://www.nerdwallet.com/article/investing/mega-backdoor-roths-work#:~:text=The%20mega%20backdoor%20Roth%20allows,2021%2C%20and%20%2440%2C500%20in%202022

https://www.forbes.com/advisor/retirement/mega-backdoor-roth/

https://www.fool.com/investing/2022/01/21/you-can-still-do-a-backdoor-roth-in-2022-but-hurry/

Securities offered through Sanctuary Securities Inc, Member FINRA, SIPC Advisory services offered through Sanctuary Advisors, LLC. A SEC Registered Investment Advisor. Ausperity Private Wealth is a DBA of Sanctuary Securities, Inc. and a DBA of Sanctuary Advisors, LLC. Do not transmit orders regarding your Sanctuary Securities, Inc. account(s) or Sanctuary Advisors, LLC account(s) via e-mail. Sanctuary Securities, Inc., Sanctuary Advisors, LLC, and Ausperity Private Wealth will not be responsible for executing such orders and or instructions. This e-mail message is intended only for the use of the individual or entity to which the transmission is addressed. Any interception may be a violation of law. If you are not the intended recipient, any dissemination, distribution or copying of this e-mail is strictly prohibited. If you are not the intended recipient, please contact the sender by reply email and destroy all copies of the document.

Fighting Inflation with I Bonds

As inflation continues to eat away at consumers’ savings and purchasing power, investors are searching for new ways to insulate their assets while also earning a reliable return in a volatile market. Enter the Series I Savings Bond, a virtually risk-free investment that promises a 9.62% return through October 2022.

Series I Savings Bonds, also known as ‘I bonds,’ have become increasingly more popular in recent months, as they are specifically designed to be a hedge against inflation. Here is what you need to know about I bonds in order to determine whether or not they’re a worthwhile investment for you.

Inflation is slowly eroding your savings

If there’s one thing we know about periods of high inflation, it’s that money loses value over time. Simply stated, a dollar today is going to be worth more than that same dollar tomorrow. With inflation levels climbing above 8%, investors who leave their money in traditional savings accounts (which tend to earn close to 0% interest) will see their funds gradually diluted.

In order to protect the value of your savings from inflation, you’ll need to earn returns that are in excess of the inflation rate. Luckily, today’s inflation rates are being outpaced by I bond interest rates, which presents investors with a unique opportunity.

I bonds can protect you from inflation

Like treasuries, I bonds are backed by the full faith and credit of the U.S. government and therefore carry a next-to-zero probability of default. But, while other low-risk investments offer similarly low yields, I bonds are currently serving up a whopping 9.62% return for discerning investors.

I bond yields are calculated by combining two interest rates: a fixed rate that’s established by the U.S. Treasury and a variable rate that scales with inflation. Although the Treasury has the option to adjust the fixed rate every six months, I bonds maintain the fixed rate that they were issued under for their full maturity of up to 30 years. The fixed rate for I bonds remains at 0% for the third consecutive year.

The variable interest rate is adjusted every six months to reflect current levels of inflation. In May and November of each year, the Treasury uses the Consumer Price Index (CPI) to set a new variable rate. A higher CPI reflects higher levels of inflation, and results in the Treasury assigning a higher variable interest rate. Unlike the fixed rate–which is guaranteed over the lifetime of the bond–the variable rate is only guaranteed for six months following the bond’s issuance. Today’s variable rate (quoted semi-annually) is 4.81%.

When taken together, these two rates result in a combined interest rate of 9.62% from now until November. That’s 9.62% of risk-free profit that you can lock in over the next several months.

A couple things to consider before investing

Investing in I bonds will not be for everyone–doing so comes with a couple important caveats that could bear significant implications for your finances; particularly, in the short-term.

Annual limits

Generally, the Federal Reserve only allows individuals to buy up to $10,000 worth of I Bonds each calendar year. These bonds are available for purchase through the Treasury Direct website. There are, however, exceptions to this rule. For those interested in stashing away more funds than the annual limit allows, there are a handful of strategies that are available.

First, if you still haven’t gotten around to filing your tax return for this past year, you can elect to receive $5,000 of your refund in paper I bonds. This effectively bumps the amount of I Bonds you can buy from $10,000 to $15,000 per year, assuming you had the prescience to submit an IRS Form 8888 with your tax return.

Second, the $10,000 annual limit (or $15,000 limit, if you take advantage of the tax refund option) applies to each individual, meaning that every member of your household can purchase this amount of I bonds. Families with children can purchase I bonds on behalf of each child, but these investments must be made in custodial accounts and are treated as gifts for tax purposes.

Finally, if you own a business or a living trust, you can purchase I bonds on behalf of those entities. Whether you’re self-employed, own a family LLC, or make investment decisions for a corporation, you can purchase $10,000 of I bonds for your business. The same goes for living trusts–as long as they’re considered separate entities come tax time, you can buy I bonds for multiple trusts if you want to. Similarly to with children, the I bonds you buy for your business or trust must be held in separate accounts.

To illustrate how maximizing your I bond holdings can look in practice, consider the following example. A married couple, each with their own business and living trust, would be able to purchase up to $60,000 in I bonds, or $70,000 if they opt for additional paper bonds as part of their tax refund. If they have a child, then they’re allowed to buy another $10,000 in I bonds per year on their behalf. Although these bonds would live in a few different accounts, that’s a total of $80,000 in inflation-protected securities.

Illiquidity

I bonds are intended to be investments that are held over a relatively-longer period of time. Once you purchase an I bond, you must hold it for at least twelve months before you even have the option to redeem it. What’s more, if you cash in your bonds before you’ve held them for five years, you must surrender the last three months of interest payments. For example, if you hold an I bond for 18 months before redeeming it, then you’ll only receive the first 15 months of interest.

These holding requirements bear important implications for investors. To start, your investment will be locked-up for at least a year, which means that you won’t be able to access your funds should an unexpected cash need arise. Further, since your earnings are diminished if you cash in your bonds early, investors are more inclined to abide by the requisite five-year holding period. This illiquidity could present challenges for some, potentially forcing them to look elsewhere for inflation protection.

Be sure to factor in the above considerations when deciding whether or not it makes sense for you to put your money into I bonds.

Best,

Join Us for Our June Webinar on Behavioral Finance!

Discover how our emotions can play a role in financial decision making. Join Shane Fox as he hosts Annmarie Woods of Guggenheim for a discussion about behavioral finance in the face of volatile market conditions.

Your Guide to Required Minimum Distributions (RMDs)

Retirement comes with both new freedoms and new rules. Learn about what you can expect when it comes to RMDs.

Tax Efficient Investing

We would like to invite you to join us for our next webinar on Tuesday, May 17th as our very own Geoff Degener hosts Ryan Gallagher of Eaton Vance for a discussion about tax efficient investing.

Inflation and Retirement: How Does It Impact Me?

The annual inflation rate in the U.S. hit 7% in the final month of 2021, a record-setting high not seen since June of 1982, as reported by Trading Economics. While this has led to increased prices at almost every store and at the gas pump, a more pressing long-term concern has emerged for many Americans; how will this impact them during retirement?

8 Things to Know About Stock Market Corrections

Scary as they are, drawdowns are a normal part of the investing process. Having a financial plan in place and sticking to it is every investor’s best friend.

Health Savings Accounts (HSA) are an excellent way of saving for medical expenses and retirement!

A Health Savings Account is the only investment account that includes the benefit of tax-deductible contributions AND tax-free distributions (for medical expenses). HSAs are an excellent way of savings for medical expenses and retirement!

3 Social Security do-over options

Did you know you can undo certain Social Security claiming decisions? Read on to learn more about claiming benefits early and wishing to withdraw your application, waiting too long and wanting to recoup that loss of income, or looking for an infusion of cash to get out of a temporary rough spot.